Admission Elegibility

- A Person (Male/Female) holding Intermediate Certificate, A-Level or equivalent Certificate from any recognized Institute with at least 50% Marks shall be eligible for admission to BS Commerce Programme.

- Admission will be on open merit basis based on marks obtained in the last degree.

- Age: A candidate must not be more than 23 years of age on October of the year of admission provided that the vice-chancellor may relax the age limit is a very exceptional case.

Academic Standing

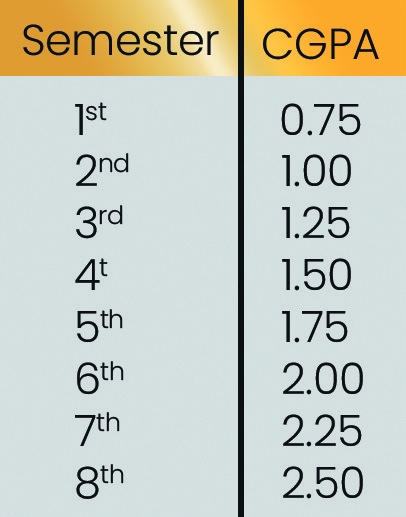

Grade point average:

- Maximum grade point average 4.00

- Minimum grade point average for obtaining the degree 2.50

- To remain on the role of university a student shall be required to maintain the following minimum CGPA otherwise he/she shall be ceased on the university role.

- A student who maintain the minimum GPA/CGPA for promotion and merits the requirements will be promoted to the next semester.

- A student who does not meet the requirements made repeat the whole semester once only. The course creates that student earns in the repeated semester shall replace the previously earned course grades.

- During the specified minimum duration for completing the degree, a student may repeat those course of the previous semester in which he/she secured the grade “F” provided the course load does not exceed the maximum limit of credit hours in a semester. Repetition of lowest grades will be allowed after completing last semester if, the CGPA is less than the degree requirements.

- In the 8th semester if, a student fails to achieve the 2.5 CGPA, he/she have to repeat the course / courses with F & D Grades, so as to make CGPA of 2.5 within the maximum time period allowed for the degree.

Proposed Study Plan BS Commerce

| Semester – I | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | IS-302 | Islamic Studies/Ethics | 2(2-0) |

| 2 | ENG-301 | Functional English | 3(3-0) |

| 3 | MGT-310 | Introduction to Business | 3(3-0) |

| 4 | MGT-321 | Fundamentals of Accounting | 3(3-0) |

| 5 | MGT-371 | Micro Economics | 3(3-0) |

| 6 | MGT-391 | Business Mathematics | 3(3-0) |

| 7 | MGT-304 | Social Psychology & Self Development | 3(3-0) |

| Total | 20 | ||

| Semester – II | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | SSH-302 | Pakistan Studies | 2(2-0) |

| 2 | MGT-404 | Business Communication-I | 3(3-0) |

| 3 | MGT-341 | IT in Business – 1 | 3(3-0) |

| 4 | MGT-322 | Financial Accounting | 3(3-0) |

| 5 | MGT-372 | Macro Economics | 3(3-0) |

| 6 | MGT-392 | Business Statistics | 3(3-0) |

| 7 | ISO-302 | Moral Foundation in Education | 2(2-0) |

| Total | 19 | ||

| Semester – III | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-423 | Corporate Law | 3(3-0) |

| 2 | MGT-405 | Business Communication-II | 3(3-0) |

| 3 | MGT-424 | Introduction to Business Finance | 3(3-0) |

| 4 | MGT-427 | Advanced Accounting-I | 3(3-0) |

| 5 | MGT-351 | Introduction to Marketing | 3(3-0) |

| 6 | MGT-411 | Introduction to Management | 3(3-0) |

| Total | 18 | ||

| Semester – IV | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-423 | Cost Accounting | 3(3-0) |

| 2 | MGT-428 | Advanced Accounting-II | 3(3-0) |

| 3 | MGT-427 | Introduction to Organizational Behavior | 3(3-0) |

| 4 | MGT-595 | Statistical Inferences | 3(3-0) |

| 5 | MGT-493 | Business Research Methods | 3(3-0) |

| 6 | MGT-473 | Introduction to Managerial Economics | 3(3-0) |

| Total | 17 | ||

| Semester – V | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-477 | Economic Issues of Pakistan | 3(3-0) |

| 2 | MGT-515 | Introduction to HRM | 3(3-0) |

| 3 | MGT-525 | Financial Management | 3(3-0) |

| 4 | MGT-502 | Principles of Auditing | 3(3-0) |

| 5 | MGT-452 | Marketing Management | 3(3-0) |

| 6 | MGT-407 | Ethics in Business | 3(3-0) |

| Total | 18 | ||

| Semester – VI | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-594 | Introduction to Logic | 3(3-0) |

| 2 | MGT-602 | Business Taxation | 3(3-0) |

| 3 | MGT-580 | Strategic Management | 3(3-0) |

| 4 | MGT-595 | Managerial Accounting | 3(3-0) |

| 5 | MGT-617 | Entrepreneurship | 3(3-0) |

| 6 | MGT-526 | Money & Banking | 3(3-0) |

| Total | 18 | ||

| Semester – VII | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-698 | Internship | 3(3-0) |

| 2 | MGT-574 | International Business | 3(3-0) |

| 3 | Elective-I | 3(3-0) | |

| 4 | Elective-II | 3(3-0) | |

| 5 | Elective-III | 3(3-0) | |

| Total | 15 | ||

| Semester – VIII | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-600 | Corporate Governance | 3(3-0) |

| 2 | MGT-699 | Research Project | 3(3-0) |

| 3 | Elective-I | 3(3-0) | |

| 4 | Elective-II | 3(3-0) | |

| 5 | Elective-III | 3(3-0) | |

| Total | 15 | ||

| SPECIALIZATIONS COURSES | |||

| Banking and Finance | |||

| (4 Courses – 2 from each segment without overlapping) | |||

| Banking | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-609 | Banking Laws and Practices | 3(3-0) |

| 2 | MGT-610 | Dynamics of Consumer Banking | 3(3-0) |

| 3 | MGT-611 | Marketing for Financial Services | 3(3-0) |

| 4 | MGT-612 | Commercial and Investment Banking | 3(3-0) |

| 5 | MGT-614 | Management of Banking Operations | 3(3-0) |

| 6 | MGT-615 | Central Banking and Global Banking | 3(3-0) |

| 7 | MGT-619 | Marketing for Financial Services | 3(3-0) |

| Finance | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-632 | Investment & Security Analysis | 3(3-0) |

| 2 | MGT-633 | Corporate Finance | 3(3-0) |

| 3 | MGT-634 | Credit Management | 3(3-0) |

| 4 | MGT-635 | Islamic Banking | 3(3-0) |

| 5 | MGT-637 | Financial Institutions | 3(3-0) |

| 6 | MGT-638 | International Finance | 3(3-0) |

| 7 | MGT-639 | Money & Capital Markets | 3(3-0) |

| Auditing & Taxation | |||

| (6 Courses – 2 from each segment) | |||

| Auditing | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-620 | Auditing and Assurance | 3(3-0) |

| 2 | MGT-621 | Forensic and Investigation Auditing | 3(3-0) |

| 3 | MGT-622 | Internal Control System, Information Systems and Compliance | 3(3-0) |

| 4 | MGT-623 | Performance Audit and Evaluation | 3(3-0) |

| Taxation | |||

| Sr. No | Course Code | Course Name | Credit Hours |

| 1 | MGT-624 | Corporate Taxation | 3(3-0) |

| 2 | MGT-625 | Sales Tax, Excise Duty and Customs | 3(3-0) |

| 3 | MGT-626 | Local and Provincial Laws | 3(3-0) |

| 4 | MGT-627 | Global Taxation | 3(3-0) |